who claims child on taxes with 50/50 custody michigan

If one parent is paying for the costs of the child and another parent is raising the child the one who is financially responsible would likely be the one who could claim the child. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

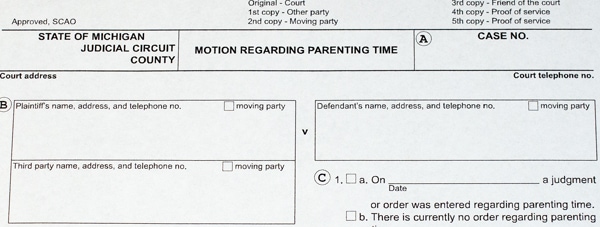

How To File Contempt Of Court For Child Custody Violation Legalmatch

Another thing that divorced or separated parents have to consider is who claims child on taxes with 5050 custody.

. Jackass whose getting away with not paying for the child or your sister because. Follow IRS tiebreaker rules for determining who gets to claim the child. Its never an even 5050 split.

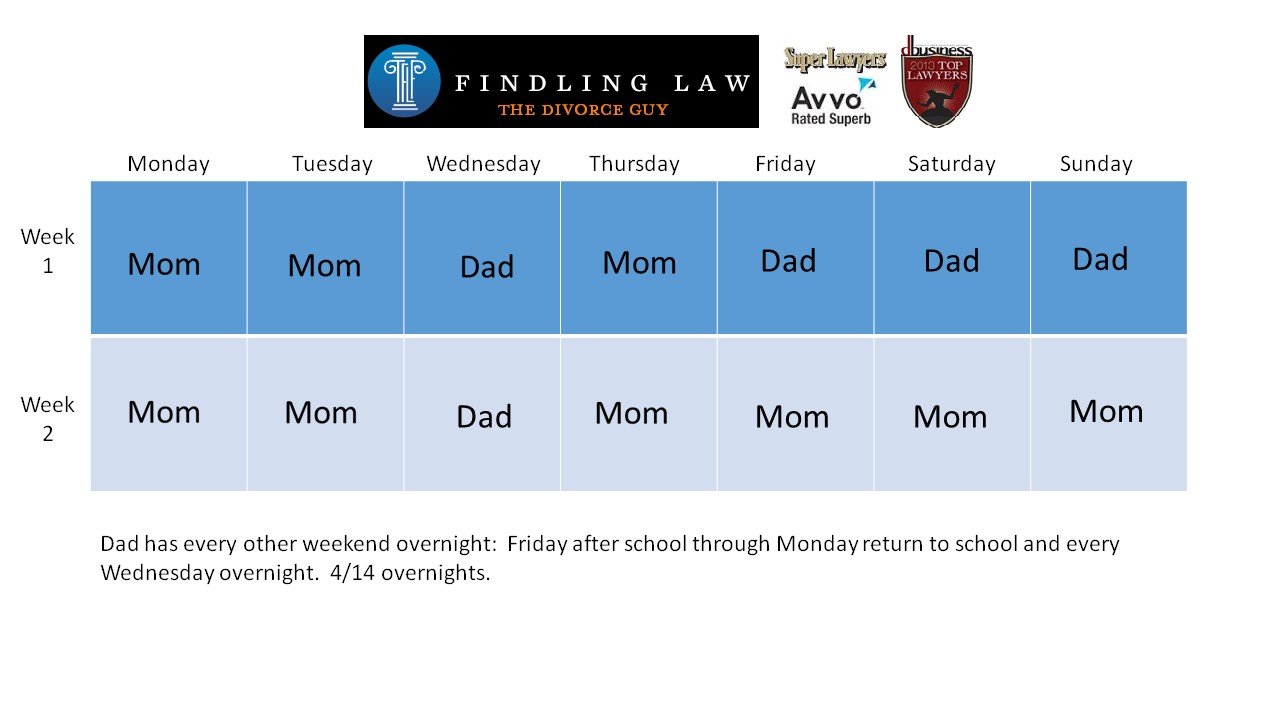

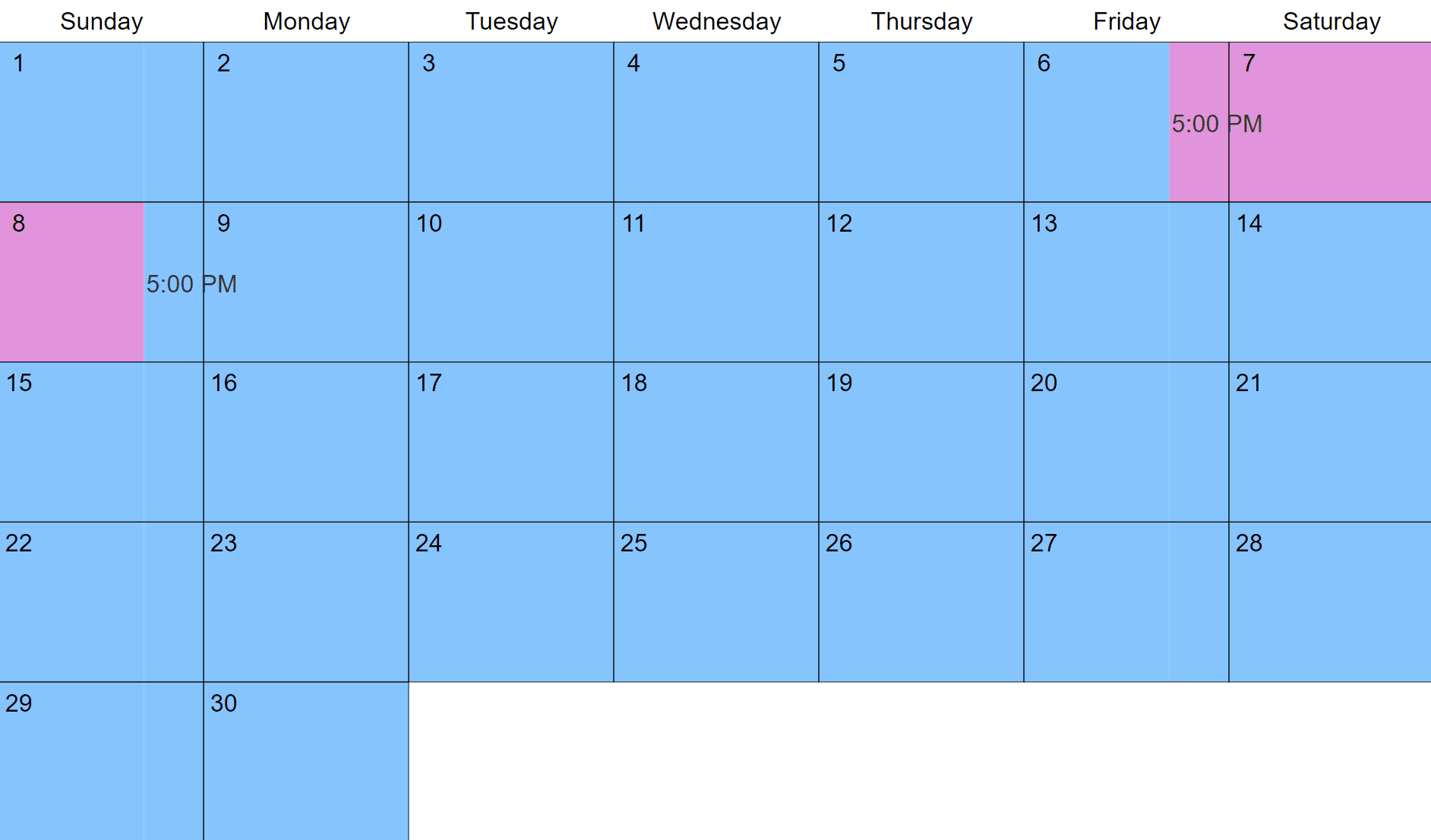

The parent who qualifies as the custodial parent under federal tax law. In most joint custody agreements there is one parent that generally handles the day-to-day care and well-being of the child. There are 365 days a in a year.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. In cases where custody is split exactly 5050 the parent with the highest income gets the benefit explains Hoppe.

So one parent claims for the child one year and the other parent the next year. 1 Have I spent more than 183 days. Typically when parents share 5050 custody they alternate.

Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. October 19 2022 September 30 2022 by John Groove. Shared custody can create a situation where one parent gets to claim the child as a dependent.

The answer to this common question during a custody arrangement can. In many cases parents with joint custody have shared. Mutually agree on who gets to claim the child as a dependent.

The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally. Secondly Im not sure who is truly the idiot. Therefore the following questions and answers may help determine who can file their dependent child on their taxes in a 5050 agreement.

This seems straightforward enough but of course there are. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Having a child may entitle you to certain deductions and credits on your yearly tax return.

Joint custody also referred to as 5050 custody gives both parents custody of their child. For a confidential consultation with an experienced child custody lawyer in Dallas. Who claims child on taxes 5050 custody PA.

However if the child custody agreement is 5050 the IRS allows the parent with. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may. The Internal Revenue Service IRS.

Who Claims a Child on Taxes With. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. In instances where there is a known custodial.

Who Claims a Child on Taxes With 5050 Custody. In instances where parents share equal 5050 custody and the percentage of nights were equal the parent who makes the most money would get the right to claim the. Who Claims a Child on US Taxes With 5050 Custody.

Parenting Time Attorney Northville Family Lawyers

Who Claims Taxes On Child When There S 50 50 Custody

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

New 3 000 Child Tax Credit Could Raise Issues For Divorced Parents

Who Gets To Claim The Tax Exemptions For Minor Children In Michigan Kershaw Vititoe Jedinak Plc

He Beat Her Repeatedly Family Court Tried To Give Him Joint Custody Of Their Children Propublica

Child Tax Exemption And Michigan Law

Prepare Your Covid 19 Coronavirus Co Parenting Plan Before It S Too Late

Visitation In Michigan Parenting Time

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Fathers Rights Utah Does Anybody Here Know If It S Required By Utah Law To Let The Other Parent Facetime Every Single Night Of Parent Time Facebook

Michigan Divorce Laws How To File 2022 Guide Forbes Advisor

Taxes Have Changed For Divorced Parents Here S What You Need To Know

Divorce Laws In Michigan 2022 Guide Survive Divorce

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Long Distance Custody Visitation Schedule Examples Create Yours

States Are Increasingly Considering Equal Shared Parenting In Custody Cases This Young Kentucky Couple Serve As A Test Case The Washington Post

Michigan Divorce Lawyer Steiger Law Office

First Child Support Payment In Three Years I Could Care Less About Receiving Any Child Support But I Asked My Ex Why He Paid Only Fifty Cents And He Showed Me The